News & Updates

Opportunity Zones Bring More Business to Florida Ports

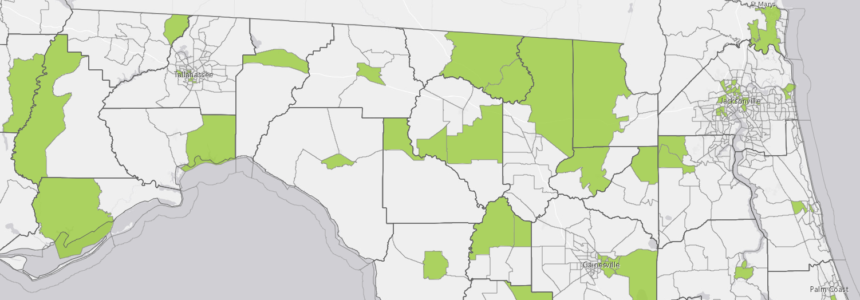

Investment and business growth in Florida’s 427 Opportunity Zones will have a positive impact on the state’s economy, and Florida’s 14 seaports will benefit from increased trade in nearby Opportunity Zone investments.

Opportunity Zones were created in the federal Tax Cuts and Jobs Act of 2017, which designated 25 percent of a state’s low-income census tracts as Opportunity Zones. The act provides tax incentives for investors with capital gains to invest in property or businesses in these low-income communities.

In Florida, every single county has at least one designated Opportunity Zone, so there are Opportunity Zones near every port, from one zone in Gulf and Monroe counties, to 32 in Hillsborough and 67 in Miami-Dade County. The Port of Port St. Joe actually sits in the Opportunity Zone designated for Gulf County.

Everyone from national investors and local developers to governments and public private partnerships have a vested interest in understanding and driving investment to Opportunity Zones in their state and communities. These investment dollars can go into Opportunity Zones all across the country, but a community-driven approach will ensure that Florida will receive its fair share of investments.

Opportunity Zone investment has already begun. Property values and the number of property sales are rising in Florida’s Opportunity Zones. Investments will be made in real estate and improvements to existing property, while also providing a place for larger capital investments to be made in buildings and infrastructure.

Industries primed for Opportunity Zone investment include manufacturing, agriculture, construction – especially in affordable and mixed-income housing – and other trade. Small but growing businesses will have a new option for access to capital, which will grow local trade, workforce and real estate.

With a focus on statewide economic development, Florida seaports have continued to grow, with more than $54 billion of cargo in 2017. A local, regional and port-specific strategy for Opportunity Zones near each port will bring increased trade to our state from the Panhandle to the Keys.

Additional Information

The specific tax incentives for Opportunity Zone investors are:

- Deferring capital gains taxes for up to seven years.

- Providing a decrease in the total taxes owed on the original capital gain if the investment is held for a five-year or seven-year period. If held for five years, the taxable liability decreases by 10 percent. If held for seven years, the total taxable liability decreases by 15 percent.

- If the investment is held in an Opportunity Zone for 10 years or more, any gains made over the life of that investment are tax free.

To give an example, if an investor takes $1 million and invests in an Opportunity Zone, in five years, the investor only owes taxes on $900,000 of the original gain. After seven years, the investor only owes taxes on $850,000 of the original gain. After ten years, if the investment is now worth $5 million, the investor owes no taxes on the additional $4 million gain over the lifetime of the investment.

Number of Opportunity Zones near major ports:

- Port of Pensacola: Escambia, 7

- Port Panama City: Bay, 3

- Port of Port St. Joe: Gulf, 1

- Port Tampa Bay: Hillsborough, 32

- Port St. Pete: Pinellas, 16

- Port Manatee: Manatee, 6

- Port of Key West: Monroe, 1

- Port Miami: Miami, 67

- Port Everglades: Broward, 30

- Port of Palm Beach: Palm Beach, 26

- Port Fort Pierce: St. Lucie, 4

- Port Canaveral: Brevard, 9

- Port of Fernandina: Nassau, 2

- JaxPort: Duval, 21

See an Opportunity Zone map of Florida: https://deolmsgis.maps.arcgis.com/apps/webappviewer/index.html?id=4e768ad410c84a32ac9aa91035cc2375

About the

Erin Gillespie is the founder of Madison Street Strategies, a leading Opportunity Zone consulting firm, supporting small businesses, investors, local communities and government entities. Their team’s extensive public sector experience supports clients with economic development, communications, policy development