News & Updates

US East Coast reaps gains from rise in Mexican ro-ro

- JOC.com

Written by Hugh R. Morley, Senior Editor |JOC.com

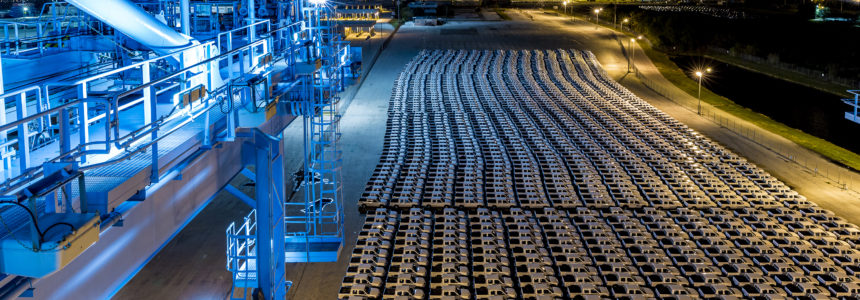

Volumes of roll-on, roll-off (ro-ro) cargo from Mexico to some US East Coast ports are rising in what some ports say is an effort by shippers to find an alternative waterborne route to increasingly unreliable cross-border land routes.

While the shift to moving autos by sea is in its early stages, several ports say questions about rail capacity and the reliability of cross border routes, along with security concerns, are prompting shippers and car manufacturers to explore the short-sea option. Vehicle exports from Mexico to the United States have risen 14 percent this year.

“Without a doubt, there is interest,” said Greg Lovelace, senior director of business development at the Port of Tampa Bay, which began its ro-ro operation a couple of years ago and moved 9,000 vehicles from Mexico in 2018. Lovelace said he hears more and more shippers inquiring about moving vehicles by sea from Mexico.

The search for new options for ro-ro echoes that of shippers of containerized goods to the US from Mexico who have begun moving goods by sea across the Gulf of Mexico, or exploring the possibility of doing so. Shippers and logistics providers say moving freight across the border by sea can be cheaper and faster, and avoids the delays of cross-border land routes and the difficulty of finding trucking capacity in a tight market.

“We have seen some signs that short-sea shipping from Mexico could become a viable option for the [original equipment manufacturers],” Lovelace said. “From what we hear, the OEMs like to have options.”

Cross-border land difficulties

The Port of Jacksonville said the share of its total ro-ro cargo that goes to or comes from Mexico — mainly new cars exported to the US — has increased from 17 percent of the port’s total auto moves for all of 2018, when the port handled 110,000 cars to or from Mexico, to 20 percent of the vehicles handled by the port in the first six months of this year. The 20 percent amounted to 75,000 vehicles handled, and most of them were inbound, said Frank Camp, director of cargo sales for the port. He attributed some of the increase to cargo going by sea instead of land.

“It’s a combination of things,” said Camp, explaining shippers’ interest. “It is issues with their rail. Over the past couple of years, there have been times where there may be a delay in the rail. Weather issues that cause delays on the rail. Or issues with pilferage, and quality in moving vehicles out of the plants in Mexico up into the US. Or issues at the border.”

Most of the incoming cars are headed for the Florida consumer market, or as rental vehicles for the tourist industry, he said.

The Port of New York and New Jersey, where the volume of cars handled in the first six months of the year — 299,129 vehicles — was 6.4 percent higher than the same period in 2018, said it is seeing a growing tide of business from Mexican ports.

“Mexico is definitely a source of new imports” for the port, said spokesperson Steve Coleman.

“As production increases, and other factors like the level of theft and damage from the rail” rise, manufacturers are working with ro-ro operators to deliver goods by sea, especially those destined for the New York consumer market, Coleman told JOC.com

“We anticipate volumes to increase in line with new and or ramped up [auto] production, which will happen over the next few years,” he said, adding the new United States-Mexico-Canada trade agreement, if signed, will enhance the shift.

US-Mexico auto relationship

The US is by far the biggest recipient of Mexican vehicle exports, and exports to the US are increasing faster than to other countries. The Mexican Automotive Industry Association reported in July the sector exported 2.01 million vehicles in the first seven months of 2019, of which 79 percent — 1.56 million — were exported to the US. Some 8 percent, or 143,764, were exported to Canada.

Exports to the US were up 14.3 percent in the first seven months of the year, compared with the same period in 2018, the group’s figures show. Canada’s export volumes fell 8.4 percent, while Mexican auto exports overall increased 3.9 percent.

Of 3.9 million light vehicles produced by Mexico in 2018, 61 percent were exported to the US, 6 percent were exported to Canada, and 12 percent stayed in Mexico, according to IHS Markit, the parent company of JOC.com. The company forecasts a 3 percent decline in Mexican light vehicles exported to the US in 2019, and annual declines until 2023, when volumes will increase.

Vehicle exports through Mexican ports — which accounted for about 60 percent of all cars moved through the ports — are also rising. However, how much of the increase is going to the US is unclear, as the figures do not report cargo destination. Exports of cars through Mexican ports increased 20.5 percent in 2018 over the year before, to 1.23 million vehicles, according to the Secretariat of Communications and Transportation (SCT), which oversees the Mexican port system.

Imports of vehicles into Mexico in 2018 fell 1.5 percent from the year before, to 994,000 vehicles, the SCT figures show.

The rapid growth of vehicle exports in 2018 slowed in the first six months of 2019, to a 4.5 percent gain, the figures show. Imports fell 1.3 percent in the same period.

Exports through Mexico’s Gulf Coast ports grew 22 percent in 2018 compared with the year prior, to 962,000 vehicles. Exports were up 15 percent through Pacific Coast ports, to 270,000 vehicles. Of the main auto exporting ports on the Gulf Coast, exports through Altamira increased 49 percent last year to 292,000 vehicles, while Veracruz exports were up 1.1 percent to 571,000, the SCT said. The Veracruz port authority said it has no ro-ro services to the US.

The Port of Philadelphia, which imports Kia and Hyundai vehicles from Mexico, said its total auto cargo volume increased about 37 percent last year compared with 2017, as measured in metric tons. That growth slowed to an increase of about 2.7 percent in the first half of 2019 over the same period in 2018.

Patrick McGinn, manager of operations support for Glovis, which operates a shipping service between Philadelphia and Mexico and an auto-processing facility at the port, said the Philadelphia increase was largely driven by Kia and Hyundai imports. Last year was Hyundai’s first full year of production in Mexico, he said. Glovis has also imported Mexican-built units from GM and Fiat Chrysler Auto in the last year, a first for Glovis Philadelphia, McGinn said.

Philadelphia is prepared to handle a continued increase in auto imports, said Peter Abraldes, a marketing analyst for PhilaPort, as the port authority is known. This fall, the port will open its first terminal dedicated solely to processing vehicles, complete with a continuous layout, straight lines, and state-of-the-art amenities for greater efficiency. The terminal will be operated by Glovis.

“Auto manufacturers are sending the autos by sea because it’s quicker and more cost effective,” Abraldes said. “There is only so much rail and truck capacity out of Mexico and the cost and transit times aren’t good enough to make it a viable solution.”